Annual federal withholding calculator

Complete a new Form W-4 Employees. Divide line 1 by line 2.

Paycheck Calculator Take Home Pay Calculator

H and R block Skip.

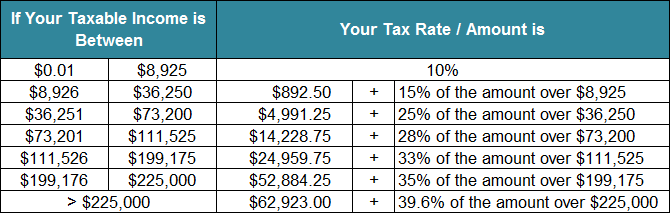

. How to calculate Federal Tax based on your Annual Income. 15 Employers Tax Guide and Pub. And is based on the tax brackets of 2021 and.

Discover Helpful Information And Resources On Taxes From AARP. Withhold 62 of each employees taxable wages until they earn gross pay of 147000 in a given calendar year. The wage bracket method and the percentage method.

Check out HR Blocks new tax withholding calculator and learn about the new W-4 tax form updates for 2020 and how they impact your tax withholdings. Number of paychecks per year 26. There are two main methods small businesses can use to calculate federal withholding tax.

250 and subtract the refund adjust amount from that. The Income Tax Calculator estimates the refund or potential owed amount on a federal tax return. The amount of income tax your employer withholds from your regular pay.

To change your tax withholding use the results from the Withholding Estimator to determine if you should. 51 Agricultural Employers Tax Guide. It describes how to figure withholding using the Wage.

Change Your Withholding. The 2022 Tax Calculator uses the 2022 Federal Tax Tables and 2022 Federal Tax Tables you can view the latest tax tables and. 250 minus 200 50.

Then look at your last paychecks tax withholding amount eg. The maximum an employee will pay in 2022 is 911400. Annual gross taxable wages 52000.

For employees withholding is the amount of federal income tax withheld from your paycheck. When you start a new job or get a raise youll agree to either an hourly wage or an annual salary. Withholding for these types of income differs from standard withholding and the estimator doesnt currently have the ability to provide these sorts of recommendations.

This is wages per paycheck. Effective tax rate 172. That result is the tax withholding amount.

2020 brought major changes to federal withholding calculations and Form W-4. Estimate how much youll owe in federal taxes using your income deductions and credits all in just a few steps with our tax calculator. But calculating your weekly take-home.

See the IRS FAQ on Form W-4 to answer your questions about the changes. The Writers Guild-Industry Health Fund and the Producer-Writers Guild of America Pension Plan collectively FundPlan administer health and pension benefits for eligible writers. Annual withholding goal 1800.

This publication supplements Pub. Ad Enter Your Status Income Deductions And Credits And Estimate Your Total Taxes. How to calculate Federal Tax based on your Annual Income.

How Your Paycheck Works. The 2022 Tax Calculator uses the 2022 Federal Tax Tables and 2022 Federal Tax Tables you can view the latest tax tables and. It is mainly intended for residents of the US.

Get Our Sample Of Employee Payroll Register Template For Free Payroll Template Payroll Pen And Paper

Tax Withholding Calculator For Employers Online Taxes Irs Taxes Federal Income Tax

How To Calculate Federal Income Taxes Social Security Medicare Included Youtube

Tax Calculation Spreadsheet Spreadsheet Spreadsheet Template Business Tax

Pin On Raj Excel

Payroll Paycheck Calculator Wave

Paycheck Calculator For Excel Paycheck Payroll Taxes Consumer Math

Python Income Tax Calculator Income Tax Python Coding In Python

.jpg)

Income Tax Calculator Estimate Your Refund In Seconds For Free

Federal Calculator Calculator Federal Credit Union Hadleysocimi Com

How To Calculate 2020 Federal Income Withhold Manually With 2019 And Earlier W4 Form

Self Employed Tax Calculator Business Tax Self Employment Self

Paycheck Calculator Take Home Pay Calculator

Income Tax Calculator Estimate Your Refund In Seconds For Free

How To Calculate Federal Income Tax

Calculation Of Federal Employment Taxes Payroll Services

Calculation Of Federal Employment Taxes Payroll Services